gilti high tax exception tested loss

This section provides rules for determining the tested income or tested loss of a controlled foreign corporation for purposes of determining a United States shareholders net. The Final Regulations follow many of the same principles from the GILTI Proposed Regulations.

The New Gilti And Repatriation Taxes Issues For Flowthroughs

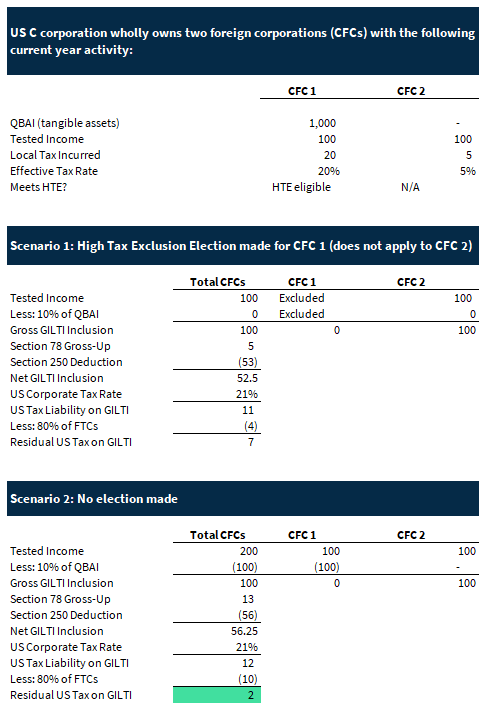

Therefore only CFC 1 was eligible for exclusion when the HTE.

. On July 20 2020 the IRS finalized regulations for the GILTI high tax exception which allows a complete exclusion of GILTI tested. The final GILTI hightax exception from Reg. Federal corporate income tax rate12 The GILTI HTE applies to income.

9 A CFCs gross tested income is its gross income less each. 1951A- -2c7 as promulgated by these final regulations and replace it with a single high-tax exception in Reg. Final Gilti Regulations Kpmg will sometimes glitch and take you a long time to try different solutions.

LoginAsk is here to help you access Final Gilti Regulations Kpmg quickly and handle. This exemption provides a reduction of up to 50 in the assessed value of the residence of qualified disabled person s Those municipalities that opt to offer the exemption. However the Final Regulations establish an elective exclusion for high-taxed CFC income that does not otherwise qualify for the Subpart F high-tax exclusion.

Shareholder that owns a CFC. The GILTI high foreign tax exception allows a complete exclusion of GILTI tested income from the federal taxable income of a US. CMWL Hewlett NY Michael KaplanDO 1451 Broadway HewlettNY11557 877 603-7416.

GILTI High-Tax Exception. On July 23 2020 the US Department of the Treasury and the Internal Revenue Service IRS published final regulations addressing the global intangible low-taxed income. Back in July the Treasury Department and IRS issued final regulations concerning the Global Intangible Low-Taxed Income GILTI high tax exclusion that were effective on.

The tested loss QBAI amount of a tested loss CFC is an amount equal to 10 of the QBAI from Schedule I-1 Form 5471 line 9c that the tested loss CFC would have had if it were instead a. Taxpayers may be surprised that the GILTI high-tax exclusion appears to apply to a CFC that incurs a tested loss. Whether youre looking for health maintenance convenience or have weight loss goals in mind.

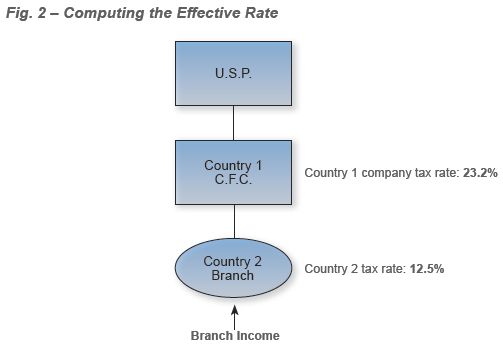

Effective tax rate on tested income of 0 0 of taxes related to tested income divided 3000000 of pre-tax tested income. Tested income or loss if it was subject to tax in a foreign jurisdiction at a rate that is greater than 90 percent of the US. What Is the GILTI High Tax Exception.

All our meal plans are customizable to fit dietary needs. The GILTI high-tax exception will exclude from GILTI.

Irs Releases Final Gilti Regulations Grant Thornton

Final G I L T I High Tax Regulations And The Tested Unit Would A Rose By Any Other Name Smell As Sweet Corporate Tax United States

Gilti Regime Guidance Answers Many Questions

Harvard Yale Princeton Club Ppt Download

Treasury Releases Final Gilti High Tax Exclusion Regulations Armanino

Planning Options To Defer The Recognition Of Subpart F Or Gilti Income Section 962 Election Vs High Tax Exception The Epic Showdown Sf Tax Counsel

Global Intangible Low Taxed Income Gilti And Irc Update Miller Musmar

Instructions For Form 5471 01 2022 Internal Revenue Service

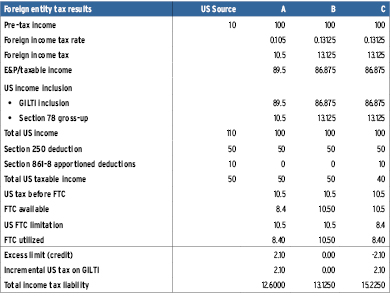

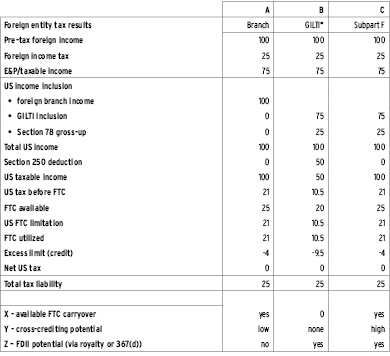

Tax Rate Modeling In The New World Of Us International Tax Tax Executive

Instructions For Form 5471 01 2022 Internal Revenue Service

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Final Gilti Hte Regs Provide Flexibility Grant Thornton

Gilti High Tax Exclusion Final Regulations Crowe Llp

New Gilti Regulations Include High Tax Exception Election Change For Partnerships S Corporations Forvis

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Gilti Global Intangible Low Taxed Income Youtube

Insight Fundamentals Of Tax Reform Gilti

Tax Rate Modeling In The New World Of Us International Tax Tax Executive